- Michael Jaconi is the co-founder and CEO of Button, a B2B platform that powers mobile commerce technology for apps.

- In this op-ed, he writes that Facebook’s announcement of Instagram Checkout poses both an opportunity and a risk – and that retailers should view it with a skeptic eye.

- Visit Business Insider’s homepage for more stories.

Amazon sells things, Google lets people find things, Uber moves things, and Facebook connects people – but now, Facebook is going to try to sell things via Instagram Checkout on top of all these connections.

Facebook was about connecting people, I agree, and that recent blitz of nationally-televised ads did make me feel warm and fuzzy – but the launch of Instagram Checkout should be viewed by retailers with a skeptic’s eye.

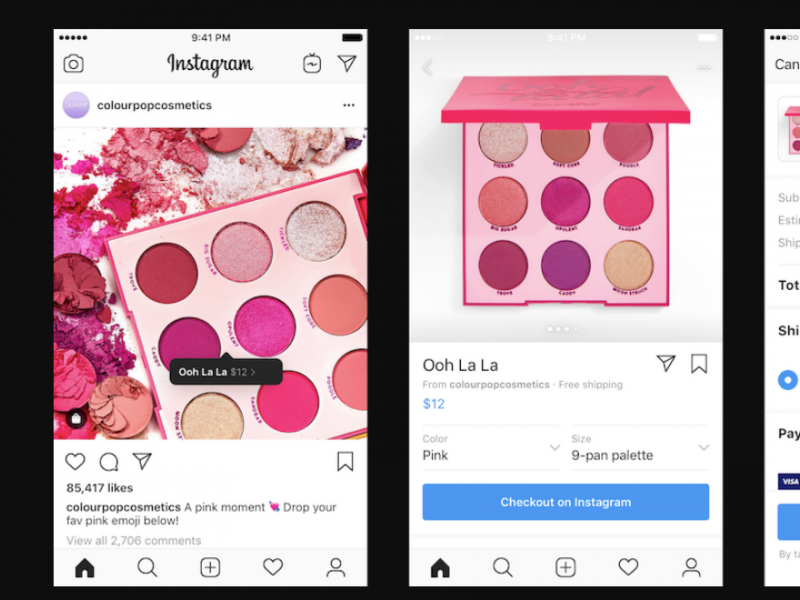

Facebook launched Instagram Checkout saying that its goal was to build a better experience for users to shop directly on Instagram. What they didn’t share is that this is a step further in the direction of Facebook’s all-out war against Google and Amazon to become the “starting point for all things.

In other words, it’s the age-old battle of the titans of the internet – from the dial-up days with AOL to Yahoo’s categorized listing to Google’s beautifully simple open query box. The new frontier is the battle for your mind, attention, and dollars in mobile.

The dilemma that retailers must now wade through is centered on whether they are willing to be disintermediated and have their customers' start and finish their shopping journeys through Facebook and Instagram, or whether these retailers want to be their customers' starting point and have customers buy from their sites and apps directly.

Disintermediation is Facebook's commerce strategy

Through simplifying the checkout process and standardizing the functionality retailers can offer through Instagram, while keeping users "within their platform," this new initiative has all the ingredients to quickly scale. But this strategy will ultimately be paid for at the long-term expense and detriment of the retailers who become dependent on it.

A brand, a feeling, or an experience a retailer can invent on their own property or in their own app is the one fleeting moment they have to foster a connection, build loyalty, and inspire that customer to come back the next time. Teams of engineers, designers, and product managers fight tirelessly to optimize every pixel of these experiences for this very reason.

If Instagram removes that opportunity by having a vending machine-like experience built for Facebook's benefit, then guess what? Your brand means nothing. Whomever can build the best method of optimizing on Instagram, using growth hacks and leveraging the data that Facebook has dubiously collected, will win. My view is, that win will be short-lived.

Retailers that have spent years building their brands, maintaining an unwavering commitment to high standards, and employing the best and brightest people to build experiences that foster loyalty will then be limited to providing experiences that are identical to their competition, to companies with far lower standards.

Without differentiation, what happens?

A cookie-cutter experience for commerce, aka the most recent attempt by Facebook to own a category they desperately need to gain ground on, isn't the answer. Look at what Facebook did to the news industry. Google built itself with a philosophy that linking users off their page was the best way to bring users back to Google. With commerce, that is still the "right view." It's also what is best for retailers. This is why Google is the best performance marketing channel that has ever existed, and frankly, that is why there is so much pent up excitement for Pinterest's IPO. No platform in the world can compete with Pinterest's ability to inspire intent and funnel it towards retailers. With 250 million MAUs and growth continuing to be seen, there is no platform better positioned to win the battle for commerce supremacy (after Amazon).

The history of on-platform commerce and buy buttons

Like many failed efforts to make everything "on platform" from the multitude of social media buy buttons, bots, to startups galore trying to tackle the universal cart problem, retailers have proven time again to be better than anyone else at driving purchases. Without consumers going to retailers, signing up and visiting their sites directly, retailers will not be able to drive those purchases and convert those users into repeat buyers as no connections will be fostered. This makes disintermediation easy for Facebook. Buying from Wish will feel like buying from Walmart, which will feel like buying from Nordstrom, which will feel like buying from Etsy.

The news industry went through this form of disintermediation, and New York Times CEO Mark Thompson, recognizing the risk of disintermediation, aptly summed it up by saying, "We tend to be quite leery about the idea of almost habituating people to find our journalism somewhere else [...] and we're also generically worried about our journalism being scrambled in a kind of Magimix (blender) with everyone else's journalism."

Retail's future

For this strategy to be successful, a new future for retail will need to emerge. Retailers that sell multiple products but are excellent at selling only one product will no longer dominate. Nordstrom started with shoes and then sold every category of fashion. That trend continued throughout the 20th century and was the playbook Amazon built from - moving from selling books to selling everything. Perhaps Nordstrom will be forced to move back to shoes alone…

The "future of retail" may emerge with single product sellers dominating. Big box, multi-category, multi-product retailers will fall further and further behind as "aggregation" is no longer a needed asset, with the platforms Facebook, Google, and Amazon "aggregating" for us. Consumer loyalty will only be built around the best products, and perhaps that's okay - but if that were to happen, it would shake the bedrock of the retail economy that is dominated by "aggregators" of all types.

The future of advertising

Regardless of the risk of disintermediation or multiple-category retail going away, Facebook's announcement of Instagram Checkout poses both an opportunity and a risk. No matter your view on the dilemma that exists, one thing that the AdTech, MarTech, and retail industries can bet on is that Facebook's introduction of the "seller's fee" is one of the most significant moves by a platform to adopt a cost per action model (CPA) - whereas most platforms have been stalwart about only charging for clicks (CPC).

What's ironic is that I've been told by every VC I've talked to that "this isn't the model" that platforms will adopt." Call Instagram Checkout what you want; some will call it "affiliate" and others will more alluringly call it a "shopping fee." Regardless, the world is heading in this direction as there is no purer model that exists - advertisers paying based on the value they're driven.

The continued march towards smarter, performance-based spending is Darwinian. It follows Google's announcement of Shopping Actions last year, and I'm confident this is just the beginning of this shift as models where advertisers pay on true performance are the most durable for all parties.

The precipitous shift of brand dollars to performance dollars has begun and is speeding up. The models that will emerge in our future will offer a "win win win" model for all parties: the publishers (in this case Instagram), retailers, and consumers. The days of paying for impressions and taps alone are gone.

If you, as a publisher, only make money through non-transactional activity (e.g. impressions and taps), a safe bet is to begin diversifying. If you acquire users only by paying for eyeballs and taps, now's the time to begin pushing more of your budget towards a performance model and paying based on the transactions driven. The tide is turning in this direction and those who act first will be the best prepared to win.

Perhaps we'll look back in five years and say that this shift in strategy by Facebook was actually the beginning of the "win win win" era. Facebook may never become a "starting point for commerce" but the model they're introducing - where advertisers pay for true performance - is the model of the future. It's the model that Amazon used to become the most durable business in the world - and now, every other platform in the world is following suit.

Mike Jaconi is the co-founder and CEO of Button, the mobile commerce platform built to maximize the value of every tap. Through higher-converting technology, Button embeds commerce experiences inside publisher apps so that brands can grow their mobile business, publishers can increase their mobile revenue, and consumers have a better buying experience on mobile. Mike formerly served as the CEO of Rakuten Loyalty and executive officer of parent company Rakuten. He helped build Rakuten Loyalty and led Rakuten's $100M investment in Pinterest.